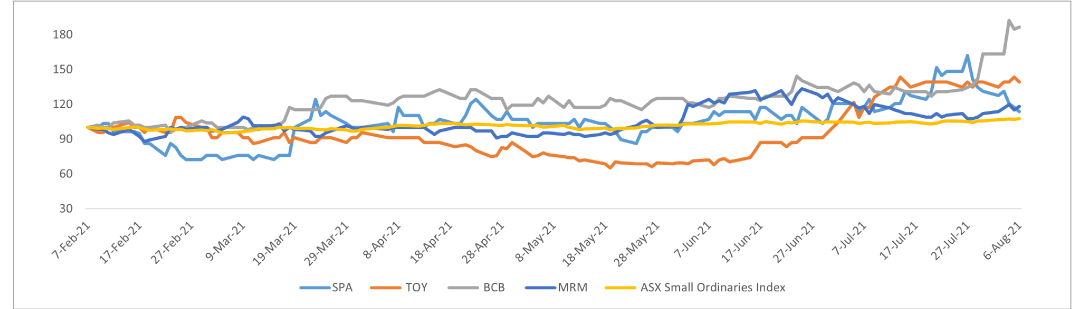

Market Beating Performers in Past 6 Months

Note: S&P/ASX Small Ordinaries Index serves as a benchmark for the comparison. Relative Performance since 7th February 2021 Rebased to 100; Data from ASX, REFINITIV, created by Kalkine (7th February 2021 to 6th August 2021)

Some Winners from Our ‘Stocks Under 20 Cents’ Portfolio*

(ASX: SPA) 61.90%

since recommendation

since recommendation

since recommendation

since recommendation

since recommendation

since recommendation

(ASX: MRM) 28.57%

since recommendation

since recommendation

*Gains have been estimated using average buy values in view of multiple recommendations given over time (7th Feb 2020 to 6th August 2021). The same also take into account dividends over the length of coverage.Past performance is neither an indicator nor a guarantee of future performance.

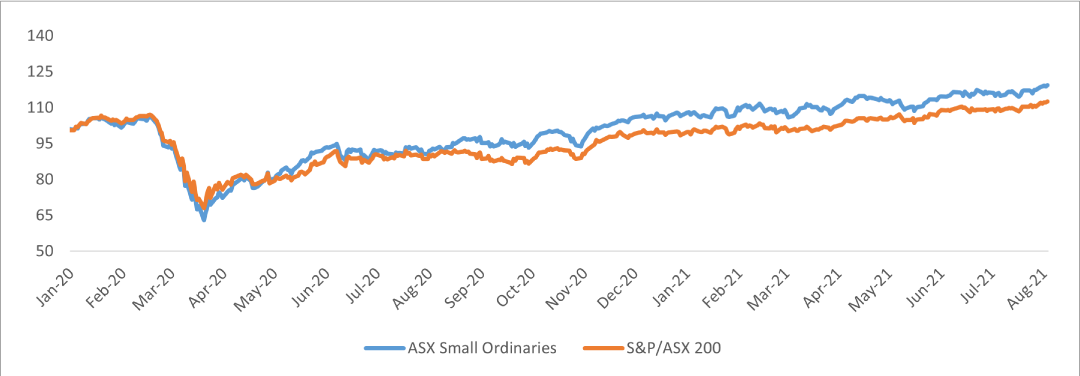

Why S&P/ASX Small Ordinaries Space Holds Some Importance?

S&P/ASX Small Ordinaries outperformed S&P/ASX 200 price returns by +3.83% in the past one year

-

S&P ASX Small Ordinaries plummeted 41% versus 36% fall in S&P/ASX 200 since the

peak in Feb’2020 - Impressive recovery of ~90% in S&P/ASX Small Ordinaries since March’ 2020 lows versus

66% recovery in S&P/ASX 200 Index

Stocks under 20 cents

For $69 For $39

- Kalkine’s ‘Stocks Under 20 cents’ report can offer access to high growth small-caps (less than $300 million market capitalization) with potential to generate alpha returns

- Remember, Investment during early stages of a company’s growth can sometimes yield tremendous rewards

- It is also important to conduct extensive due diligence as associated risk(s) is also higher for such stocks

- Avail advantages from market disruption

- We aim to cover businesses with improving balance sheets and ROE while highlighting the proportionate level of risks to be looked at

Risk-Reward Trade-off for Small-Cap Investors

- Investors should be wary of the velocity and gravity of stock market correction for small-cap stocks as panic sweeps in during uncertain times

- Highly leveraged businesses with discretionary revenue sources may be more prone to volatility

- Small businesses carry higher risk(s) versus well-established large-cap and mid-cap companies

- Systematic or unsystematic risks need to be analyzed in a comprehensive manner to minimize the uncertainty around stocks

Thousands of Loyal Members

We have been proudly featured in

We have been proudly featured in

News

Finance

Global

Business

Sun

Banker

Contact us

-

Suite 202, 234 George Street, Sydney, New South Wales, Australia. 2000

-

Toll Free No: 1800-272-662

(02) 9042 2324, (02) 9042 2353, (61) 29159 2555

Disclaimer - Kalkine Pty Ltd (ABN 34 154 808 312) holds Australian Financial Services Licence (425376). Kalkine is authorised to provide general advice only. The information on https://www.kalkine.com.au/ does not take into account any of your investment objectives, financial situation or needs. Before you make a decision about whether to acquire a financial product, you should obtain the Product Disclosure Statement from the product issuer. You should consider the appropriateness of advice taking into account your own objectives, financial situation and needs and seek independent financial advice before making any financial decisions.